Explore the Troubling Realities of the Credit Reporting Industry

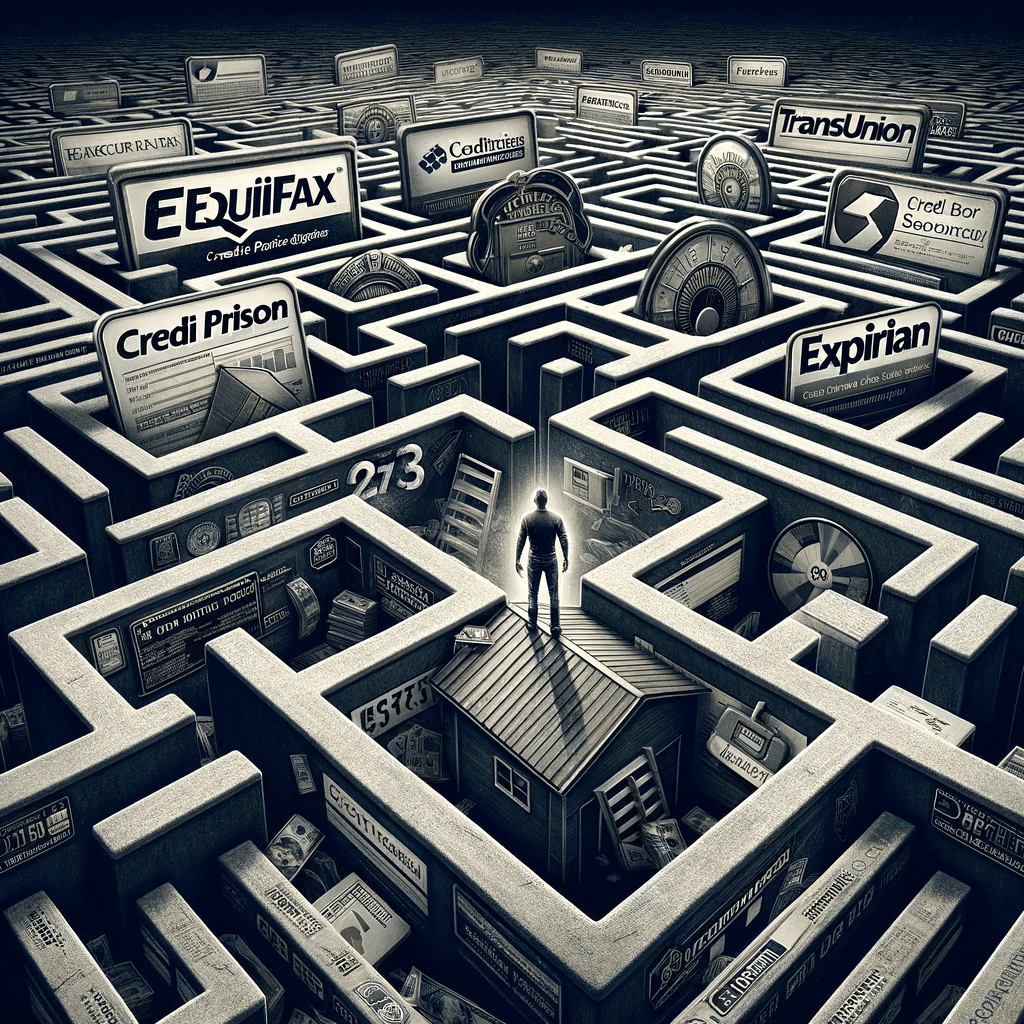

Introduction: Unraveling the Credit Prison Trap Equifax, Experian, and TransUnion significantly impact consumer rights and financial freedom by creating a ‘credit prison trap’.

The Critical Role of Credit Reporting Agencies These agencies are crucial in loan, housing, and employment decisions. However, their operations often lead to credit disenfranchisement, trapping consumers in poor credit scores.

The High Cost of Reporting Inaccuracies Frequently, these agencies produce inaccurate data. As a result, individuals are labeled high financial risks, which can lead to high loan rates and job security challenges, particularly for military personnel.

The Accountability Challenge in Credit Reporting Moreover, addressing credit report inaccuracies is daunting. Equifax, Experian, and TransUnion demonstrate a lack of accountability, evident in their poor complaint resolution record.

Data Security and Consumer Risk Additionally, the 2017 Equifax data breach exposed significant vulnerabilities. This breach put millions at risk and raised questions about the agencies’ commitment to protecting consumer data.

Decoding the Credit Scoring Process Furthermore, the credit scoring process is often unclear, suggesting possible lender favoritism. This lack of transparency leaves consumers in the dark about their credit scores.

Consumer Rights and Credit Reporting Currently, consumers have limited control over their financial narratives. Despite the potential for reforms, the credit agencies resist changes, perpetuating the credit trap.

Conclusion: The Urgent Call for Credit Reporting Reform Consequently, the control exerted by Equifax, Experian, and TransUnion leads to numerous issues like errors, poor oversight, and data breaches. This necessitates urgent reform to escape the ‘credit prison trap’.

Credit1Solutions.com: Your Champion in Credit Rights

Legal Advocacy for Financial Justice Credit1Solutions.com, armed with legal expertise, actively pursues damages for credit report and score abuse, advocating for consumer rights.

Our Track Record: Proven Success in Defense of Consumer Rights Importantly, our efforts have resulted in over $60,000 in damages for our clients, proving our commitment as a strong ally.

Why Choosing Credit1Solutions.com Makes a Difference Our team extends beyond credit repair. We tackle the legal ramifications of credit inaccuracies, seeking compensation for negligent reporting.

Partnering with Credit1Solutions.com for Financial Empowerment Ultimately, our goal at Credit1Solutions.com is to restore your financial autonomy. We offer the legal expertise and proactive approach essential for financial freedom. LEAR MORE